This past week, an unbelievable phenomenon has hit the big-screens world-wide.

…

Scratch that. TWO massive figures have hit the big-screens world wide, and they’re walking away with a 338 million dollar gross revenue.

In addition to that, the world has just experienced the greatest surge in estrogen levels ever.

Yes, New Moon of the Twilight Saga has just been released this past week, and ladies of all ages are hoarding into cinemas to try and get an eyeful of Edward and Jacob. The box office numbers for New Moon has been recorded as the third largest ever, even surpassing its previous installation of the Twilight series.

The secret to it’s success? Two “gorgeous” main actors, and a handful of guys revealing as much skin as legally possible for a PG-13 movie.

As we compare the first movie and the second, we instantly notice that the second movie is significantly more successful.

Another observation that we make is that Edward and Jacob both have significant screen-time, as compared to only Edward in the first movie.

Oh yeah, and the second movie has more topless men.

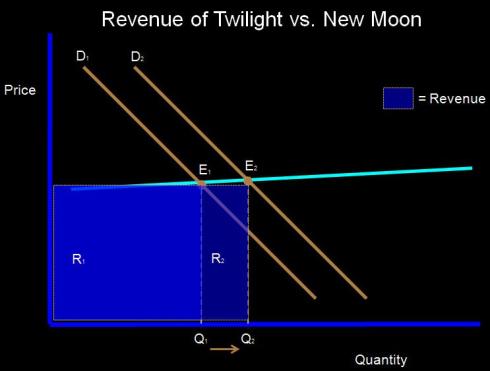

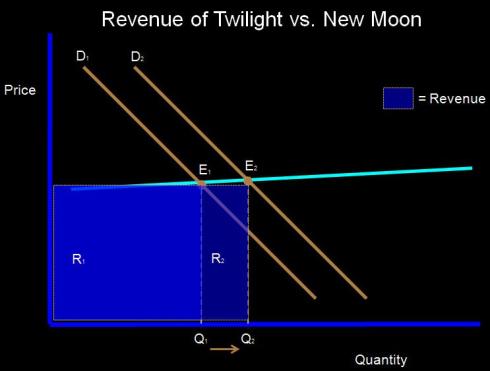

So, to portray this comparison in a diagram:

The supply of movies is almost perfectly price inelastic: almost all movie theaters keep their ticket prices constant.

However, the demand shift for the 2nd movie shifts right because of consumer tastes and preferences. Put yourself in a girl’s position: would you watch a movie featuring 1 hot guy or 2 hot guys? The answer is pretty obvious. The equilibrium quantity is higher and therefore, the total revenue for the second movie is larger than the total revenue for the first movie.

Now, let’s not bully the female population here. A few months ago, the sequel of the movie Transformers was released, featuring the sexy Megan Fox. This sequel (just like New Moon), exceeded the box office numbers of its prequel.

How did Transformers do it?

Unlike New Moon, the directors of Transformers did not increase the number of sexually appealing actresses featured in the movie. (The alien that was disguised as a girl does not count) Instead, they decided to further expose Megan Fox through skimpier clothes and longer screen time.

And the result?

Identical.

So a word of advice to future directors: if you are planning to direct a movie targeted at young audiences, increase the number of sexually appealing actors and/or actresses, and decrease the number of clothing articles worn by these actors/actresses. Sex sells.